Spidersecu

Don't Believe the Hype

Gutsycurene

Fanciful, disturbing, and wildly original, it announces the arrival of a fresh, bold voice in American cinema.

Nayan Gough

A great movie, one of the best of this year. There was a bit of confusion at one point in the plot, but nothing serious.

Hattie

I didn’t really have many expectations going into the movie (good or bad), but I actually really enjoyed it. I really liked the characters and the banter between them.

bretcarbone

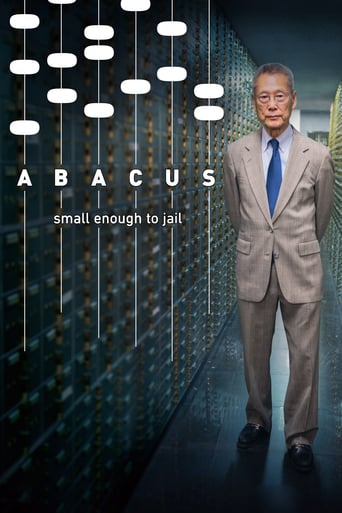

This documentary had me fuming. The Too Big to Fail Banks got off scot-free, and actually made money from the crisis they created. Meanwhile, a bank catering to a migrant community, who tries to do the right thing gets screwed by an overzealous, politically motivated DA.

Jimmymle

This documentary shows you how politically motivated are the justice system. Rather than picking on banks that defrauded American trillions of dollars, they choose to indict a small family bank in Chinatown.

T's disgusting when you understand the scope of what the mortgage crisis did to America and not surprising that the only ones prosecuted were Chinese-American.The DAs in this film looks like pompous legal heavy hitter-wannabes tainted by self-righteous vain-glories.

dack

This is a well-constructed documentary. You may even enjoy watching it. But I found it incredibly frustrating because *none* of this ever would've happened if Vera Sung hadn't told one of her bank's customers -- who objected to losing a significant downpayment as a result of one of her employee's actions -- to file a complaint at the *police precinct*.(You can see this scene at about 13:30 in the Frontline version.)By treating this couple as criminal co-conspirators instead of customers, Vera Sung brought this entire thing on her and her family. It's really that simple. And it's unfortunate this fact is completely lost on both the Sungs and the documentarian.Years of litigation and a $10 million defense is perhaps a bit steep of a karma price tag, but not far off.

wkcranberry

This movie is about a community savings bank in NYC servicing the Chinese immigrant community.The Bank had a deposit run in 2003 after news broke that a rogue employee had stolen money from the bank, and that run nearly closed the bank and required millions in expenses to fix. Likely as a result of the losses, the bank needed to find offsetting income and focused on real estate lending and then selling loans made to Fannie Mae. The Bank made good income on such activities beginning in 2009.At most community banks including Abacus, commissions are paid to lower and mid-level loan officers of the bank to find loans which are profitable to the bank when sold, but unfortunately some greedy and unscrupulous or lowly scrupulous loan officers will coach loan applicants on how to game the system to obtain a loan that they do not qualify. At Abacus, rogue loan officers did exactly that by coaching loan applicants how to lie on applications whether by false income or collateral.It is the responsibility of the independent underwriting team at the Bank to check and double check those facts. In this movie, the prosecution tries show that the Bank and senior officers were complicit in making fraudulent loans by not catching the false applications. The trial lasted more than 2 months with witness after witness admitting the information in their application was false though not always with the help of the lower bank officer. So the question was should the bank and higher officers be found guilty of fraud for not catching this. I believe the jury reached the correct verdict, though neither the Sungs nor the DA should be in the clear for noncriminal wrongdoing. The DA for being too ambitious to make a big name for himself and the Sungs for not being more vigilant in their pursuit of the gold. The trial cost the bank and Sungs millions, and as a result the Bank entered a formal agreement with the OCC to improve profitability after losses related to the trial costs. It was interesting that Jill Sung, President did not testify in the trial and that she works in a Chinese bank not being able to speak Chinese. Mrs. Sung was right that banking should have been left to others.