Fluentiama

Perfect cast and a good story

GetPapa

Far from Perfect, Far from Terrible

Micah Lloyd

Excellent characters with emotional depth. My wife, daughter and granddaughter all enjoyed it...and me, too! Very good movie! You won't be disappointed.

Ezmae Chang

This is a small, humorous movie in some ways, but it has a huge heart. What a nice experience.

classicalsteve

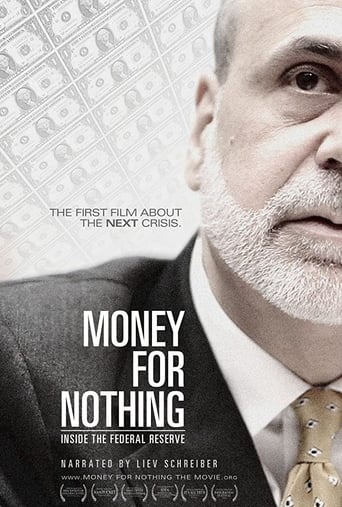

One of the best documentaries I've seen demonstrating how the role of the Federal Reserve contributed to the Financial Crisis of 2008. In the wake of the financial collapse of 2008 creating a Recession which could have led to another Great Depression, a lot of blame was leveled against Investment Banks who were vilified as being greedy, particularly Lehman Brothers and Bear-Stearns, and insurance companies like AIG who undertook too many credit default swaps. The financial banks had taken on nearly as much debt as their assets, particularly in sub-prime mortgages, and AIG had insured them against default, i.e. "default swaps". When Lehman went bankrupt, AIG owed trillions of dollars in insurance against default, which nearly brought down the financial system.Now, while Lehman and Bear-Stearns share plenty of the blame in the recent crisis, these bad debts and faulty reliance on sub-prime mortgages were not solely private sector malfeasance. A US department agency also played a crucial role: The US Federal Reserve. The US Federal Reserve ("The Fed") since Alan Greenspan became Fed Chairman in the late 1980's under then President Ronald Reagan engaged a more "hands-off" policy in terms of financial regulation and at the same time allowed much more loan money to be acquired by these private financial institutions who in turn bought into risky investments. This documentary outlines why the Fed was created in the first place, its role over the years in terms of both regulating and stimulating financial markets and what it did and didn't do to contribute to the recent financial collapse. While I don't believe the Fed was solely responsible for the financial collapse, as suggested by the film, their policy approaches were vital as one of many contributing factors which created a financial "perfect storm".Two of the leading characters whose roles were crucial in the Fed's policy-making in this unfolding drama were the two Fed Chairmen Alan Greenspan (1987-2006) and Ben Bernanke (2006-2014). Greenspan in particular was touted as a financial guru who understood financial markets better than a Super Bowl winning football coach understands how to get first downs and touchdowns. If Greenspan didn't know the answer to an aspect of the financial market, the question itself must be flawed, or so went the conventional wisdom for nearly 30 years. To his credit, Greenspan had steered the US economy through several storms. What he didn't know was that a financial hurricane was descending upon Wall Street.Over and over, Greenspan had opportunities to regulate aspects of the financial markets, particularly the so-called credit default swap insurance policies, issued by the likes of AIG and others. He also could have reigned in loose lending practices. Once, early on as Fed Chairman, Greenspan hinted the stock market may be spiraling out of control, but was quickly vilified by Wall Street for his remarks. Since then, during much of his tenure, he took a position of deregulation in which "the market will figure it out" approach so prevalent in Conservative politics. Ben Bernanke, who is a self-described scholar of the Great Depression, also didn't see the financial collapse coming. In several interviews prior to the beginning of the collapse, Bernanke iterates the impossibility of a national drop in housing prices. His scholarship for some reason precluded him from seeing the coming crisis, first in terms of the bursting housing bubble, then the ensuing financial crisis which was spawned as a result.While scholars have debated and will continue to do so over the next century over the reasons for the financial crisis, several things are clear about the Recession. The Fed contributed to the collapse with certain policies, greed does not necessarily regulate itself, and no single individual can know everything about every aspect of the market. At the ensuing congressional hearings which Congress called after the collapse, Greenspan admitted the flaws of his policies. He said he assumed that financial institutions would always make the best decisions which would be in the interest of their companies. The reality is, just like everything else in a complex modern world, the private sector cannot always be counted on to make the best of decisions, be it for their companies or the worldwide economy. The Fed has a role to play in at least helping to thwart a possible crisis in the future. That role is always endlessly debated by politicians, congressmen, financiers, advisers and occasionally scholars. Let's hope the financiers won't always get 100% of their desires.

amarbdmi

the best Documentary on the topic are the money master and Money As Debt,i assume the producer At least have seen them but they haven't.for the part where money was created,Borrowing is the major way ,when someone Borrow from bank where does the money come from,does it came from your Account? i don't think so . if this was the case you will notice. does it come from bank's money? i don't think so ,they need it for the Bonus. in fact it's money from nowhere created by the bank, it's a Obligation that bank has to pay the Borrower in exchange for the the Promise that the Borrower will pay back more, yes it's that twisted, for instance the Borrower spend the money and the money usually end up in some Account in the bank, bank's Assets(everyone's saving plus the Borrower's Promise) and its liability (Obligation to pay Depositor and the Borrower) both increase ,and as long as the bank's Assets is greater than its liability ,the came can continue forever.as for the fed which is a Private bank with its own share holders just as the Central Bank of the United Kingdom, it is responsible for the Creation of U.S. dollar. the Borrower is US government. as for Greenspan who has been Praised a lot by the movie (at least by the people they Interview) is not the Reason for the U.S. economy to be Prosperity in 1990. the true Reason is that sucker like china gone dollar-Fever , they pumping low-cost merchandise into US in exchange for green paper which keep the Cost of Living low while Destroy the manufacturing industry of US thus free the whole Country to work in Financial sector which Attract suckers all over the world to Invest in its Stock market. lots of Big shot Appear in the movie, but it didn't help, because they only help Themselvesin the end they try to Summary that the wallstreet did what they did because fed made the money easy and the fed did what they did because they are simply unware of the Consequence of their Behavior, which is so not true, anyone with a basic Knowledge of Economy knows what would happen if the Leverage was too higha better choose of Documentary on Financial crisis would be inside job and meltdown by cbc

zd3921

The movie ends by suggesting that the latest bubble was essentially caused by an 'Asset Inflation' due to the fact that apparently the US Federal Reserve no longer takes into account housing or essentially fuel prices!? What, that is obviously false... Check the US Bureau of Labor Statistics and you will see that both are definitely in there.I would agree that they have changed the way that some items have been covered, namely the housing prices which are now calculated as basically the rental equivalent of each home owners home instead of the housing price. Though, that is common among the OECD nations just like Canada and a few others. Check the US Consumer Price Index website and you will see. Also check this link, which explains some of the misconceptions out in the general public: http://www.bls.gov/cpi/cpiqa.htm As for the rest of the movie, well it hammers away at your intelligence with misinformation and jarring commentary. The movie was partly informative for creating an interesting story of Volcker, Greenespan and whatever the liar in charge of the Fed is called. Still too many logical fallacies and misrepresentations using often false information. I would give this more than 2 thumbs down if I could.

oatmeel73

End the Fed is a 2009 book by Congressman Ron Paul of Texas. The book debuted at number six on the New York Times Best Seller list[1] and advocates the abolition of the United States Federal Reserve System. SummaryPaul argues that "in the post-meltdown world, it is irresponsible, ineffective, and ultimately useless to have a serious economic debate without considering and challenging the role of the Federal Reserve."[2]In End the Fed, Ron Paul draws on American history, economics, and anecdotes from his own political life to argue that the Fed is both corrupt and unconstitutional. He states that the Federal Reserve System is inflating currency today at nearly a Weimar or Zimbabwe level, which Paul asserts is a practice that threatens to put the United States into an inflationary depression where the US dollar, which is the reserve currency of the world, would suffer severe devaluation.A major theme throughout the work also revolves around the idea of inflation as a hidden tax making warfare much easier to wage. Because people will reject the notion of increasing direct taxes, inflation is then used to help service the overwhelming debts incurred through warfare. In turn the purchasing power of the masses is diminished, yet most people are unaware. Under Ron Paul's theory, this diminution has the biggest impact on low income individuals since it is a regressive tax. Paul argues that the CPI presently does not include food and energy, yet the these items are the items on which the majority of poor peoples' income is spent.He further maintains that most people are not aware that the Fed – created (he asserts) by the Morgans and Rockefellers at a private club off the coast of Georgia[3] – is actually working against their own personal interests. Instead of protecting the people, Paul contends that the Fed now serves as a cartel where the name of the game is bailout -- or otherwise known as privatized profits but socialized losses.Paul also draws on what he argues are historical links between the creation of central banks and war, explaining how inflation and devaluations have been used as war financing tools in the past by many governments from monarchies to democracies.