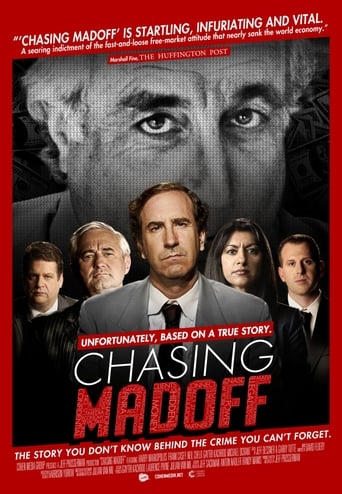

Softwing

Most undeservingly overhyped movie of all time??

Platicsco

Good story, Not enough for a whole film

Fairaher

The film makes a home in your brain and the only cure is to see it again.

Gary

The movie's not perfect, but it sticks the landing of its message. It was engaging - thrilling at times - and I personally thought it was a great time.

Larry Silverstein

This documentary, written and directed by Jeff Prosserman, is an absolutely scathing indictment of the SEC, our Federal Gov't, and Wall Street. I remember when the Madoff fraud came to light, amidst the world financial crisis, seeing Harry Markopolos testifying before Congress, and giving other interviews. I was incredulous at first, that his man had tipped off the SEC about Madoff many years before and that no action was taken. However, as the truth and the facts have emerged, I now believe every last scintilla of what he said.How is this possible? The SEC, whose primary role is to investigate fraud in the financial industry and make sure the players in the financial world are playing by the rules, did nothing to expose a multi-billion dollar fraud. They couldn't even make a few phone calls, as Markopolos states, which would have easily exposed that their alleged trades were never done.You see in the film, several members of Congress, grilling present and former SEC execs and auditors, and asking the same question. None of them had any answers. Yet, now years later there have been very few arrests and indictments not only regarding the Madoff case but for any of the fraudsters involved in the world banking crisis. So, one may ask have we really learned our lesson? The documentary is kind of a strange one because it can really be melodramatic as Markopolos recounts all the events that occurred regarding Madoff. He may even seem a little paranoid at times, as he worries about his, and his family's safety, as a prime whistleblower. My personal opinion is that he had reason to worry, as strange beatings, threats, and deaths have occurred to some who put themselves out there like that.To me, in summary, this is a scary piece of film, which highlights how embedded the elite are in running our financial systems. Is it any wonder that the Occupy Wall Street messages caught on like wildfire for awhile. The 1% almost always run the show at the expense of the rest of us 99%er's

Maggie987

There seems to be a lot of polarity about this film. People seem to either love it or hate it. I don't get this. People who make investments are relatively well off. You can't invest with Bernie Madoff in an IRA or a 401(k), so we are talking about people that have money to invest beyond an IRA or a 401(k). We are talking about rich people. People with millions and millions of dollars that they don't know what to do with. These people need to be PROTECTED from the actions of the likes of Bernie Madoff. That's right. Rich people need -the government- to protect them from the being ripped off. Yes, even liberals, or people that you think are liberals, can see that rich people need to be treated fairly.

raypaquin

Read the other reviews. There, you will find two schools of thought; those who rate this documentary ***very*** highly and those who rate is ***very*** poorly. What's going on ? This is, I believe, a microcosm of the United States today where simplistic ideology rules Washington. On one hand, you will find those who argue that more regulation is needed and, on the other hand, those who argue that less regulation is the cure because the bureaucrats in Washington are unable to regulate competently. The facts are that if your local firemen are incompetent, the solution is NOT to eliminate fire-fighters, as some right-wingers argue, but to insure that they are competent. The solution is also NOT to increase the number of firemen, as some left-wingers argue. Essentially, this documentary argues not from the viewpoint of Bernie Madoff's evil, but from the viewpoint of the incompetence of Washington bureaucrats. THAT is the truth.

Chris_Pandolfi

"Chasing Madoff" is a documentary that plays like a tightly wound political thriller. There's no action or major special effects, which is fine because they're not necessary – the facts alone are liable to get your heart pounding in sheer suspense. It presents to us the story of former securities industry executive Harry Markopolos, who, along with a team of trusted investigators, would embark on a ten-year odyssey to expose Bernie Madoff's Ponzi scheme, the largest act of financial fraud in history. As he risked everything following a trail of complicit white-collar henchmen, he found himself at odds with the press, who would mysteriously undermine his efforts to tell the public the truth, and with the U.S. Securities and Exchange Commission (SEC), who failed to act despite being repeatedly tipped off. He would eventually go on to author the book "No One Would Listen: A True Financial Thriller."It began back in 1999, when Markopolos still worked for Rampart Investment Management. One of his company's trading partners was working with Madoff, a hedge fund manager who could consistently deliver net returns of one-to-two percent a month. Hoping to get the trading partner to diversify away from Madoff, Markopolos was asked to design a product very similar his split-strike conversion. But within five minutes of looking at Madoff's revenue stream, Markopolos knew something was drastically wrong; the chart showed a stream that continued to rise at an almost perfect forty-five-degree angle, which would be impossible given how badly Madoff's strategy was structured on paper. Markopolos also knew that, even in the best of conditions, markets are always too volatile to allow for such returns. There were only two possible explanations, neither of which was legal: Either Madoff was front running, or he was the mastermind of a Ponzi scheme.Several attempts at deconstructing and replicating Madoff's strategy, made possible through information on his trades in stocks and options, proved that his returns could not be simulated. At this point, Markopolos and several colleagues at Rampart took it upon themselves to investigate Madoff. A formal complaint was filed with the SEC, but they took no action whatsoever. After travelling to Europe, where he discovered that fourteen funds were invested with Madoff, Markopolos had gathered enough conclusive data to draft a twenty-one-page memo – "The World's Largest Hedge Fund is a Fraud" – and send it to the SEC. This was in November of 2005, at which point he was consumed by the need to bring Madoff down. His efforts proved threatening to his own safety; many of the funds invested with Madoff were operated offshore, which could only mean ties to the Russian Mafia and drug cartels from Latin America.At what point is an investigation no longer worth the risk? Writer/producer/director Jeff Prosserman examines Markopolos just as closely as he does the Madoff scandal. We see a very humble military man who has dedicated seventeen years of his life to part-time service in the Maryland Army National Guard and Army Reserve. We see a devoted husband and father. Most importantly, we see a financial expert whose almost obsessive need to blow the whistle on Madoff lead to paranoia. Highly effective dramatic reenactments, starring Markopolos and his family, show the lengths he went to ensure not just his safety, but also the safety of his family. He would check every inch of his car each morning to make sure there were no explosive devices. He became a sniper. He instructed his wife on what to do should anyone ever break into the house, namely stand at the top of the stairs with a gun and keep firing until all the bullets ran out. While walking in the woods, he taught his sons to avoid stepping on twigs; if anyone wanted to hurt them, the snapping noises would give their positions away.Intertwined with the Madoff case are brief interviews with a few of Madoff's victims, who lost absolutely everything they had. They're not identified by their names, but rather by their case numbers. This was, I believe, an intentional move on Prosserman's part; despite the impersonal labels, which reflect how someone like Madoff would view them, reasonable, compassionate audiences will see them as damaged human beings. Their heartbreaking stories of financial ruin are second only to the tragedy of Thierry de la Villehuchet, a French businessman who, because of his involvement with Madoff, committed suicide in 2008. If you think about, it was actually a rather noble act on his part. When you damage something beyond repair, even inadvertently, the decent thing to do is take responsibility for your actions.The true villain of this story is the SEC, which missed numerous red flags and ignored all of Markopolos' early tips. Key figures of the organization – most notably Linda Thomsen, its top enforcement official – were not fired from their positions. Instead, they were allowed to resign. As for Madoff, yes, he was ultimately arrested and sentenced to 150 years in prison. But for Markopolos, it's a bittersweet victory. He believes Madoff was caught not because of actual investigative work, but simply because he could no longer carry on under the weight of his own lies. In effect, he gave himself up and jail was the only option he had left. He also believes that Madoff personally kept less than one percent of the $65 million he stole, and that he'll be cheated out of whatever remains by money launderers. "Madoff will wind up in a special prison designed as much to keep the crook's victims out as Madoff in," he said in a "Boston Herald" interview. "He's a guy who can't afford not to be in prison." So you tell me: If by being in prison he's under the protection of the American government, has justice really been served?-- Chris Pandolfi (www.atatheaternearyou.net)